Staff Writer

THE World Bank is projecting 6.2% economic growth for Zimbabwe in 2025, which almost tallies with Finance minister Mthuli Ncube’s 6% forecast.

Ncube says this summer’s delayed rains should not hamper the country from registering growth.

In 2024, the international financial institution estimated that Zimbabwe’s gross domestic product (GDP) grew by 2%, weighed down by the El Niño-caused drought and a slowdown in global commodity prices.

The World Bank, in its Global Economic Prospects report released on 16 January 2025, says developing economies — which fuel 60% of global growth — are projected to finish the first quarter of the 21st century with the weakest long-term growth outlook since 2000. Even as the global economy stabilises in the next two years, developing economies are expected to make slower progress in catching up with the income levels of advanced economies.

The global economy is projected to expand by 2.7% in both 2025 and 2026, the same pace as in 2024, as inflation and interest rates decline gradually. Growth in developing economies is also expected to hold steady at about 4% over the next two years. This, however, would be a weaker performance than before the pandemic — and insufficient to foster the progress necessary to alleviate poverty and achieve wider development goals.

Addressing a 2025 World Economic Forum Engagement on the X Spaces platform this Thursday, Ncube sought to paint an optimistic picture of Zimbabwe’s economic prospects, saying the country would register broad-based growth in various sectors.

“Despite the delayed rains, we still expect a 6% GDP growth rate. The recent rains have renewed optimism for a better harvest, following last year’s drought caused by El-Niño,” said the minister.

He underlined the importance of agriculture in the economy not only as a strategic sector but also through value chain linkages.

But some independent analysts say Ncube’s overly optimistic appraisal of the country’s prospects is detached from the stark economic realities on the ground.

Morgan and Co, a securities firm, has forecast lower economic growth for Zimbabwe in 2025, at 5.5%, citing various factors including uneven rainfall distribution.

Retrenchment bloodbath

In a country whose formal unemployment rate is estimated at 90%, a massive retrenchment bloodbath is rocking the economy, with many distressed companies either laying off, downsizing or shutting down after the December 2024 holidays.

A liquidity crunch, an unworkable exchange rate, policy uncertainty and political instability are feeding into a volatile economic environment that has pushed companies to the brink.

The retail sector — particularly supermarket chains — is struggling to restock and cover overheads.

Cost-of-living crisis

The cost of living is unbearably high and the number of people struggling with extreme poverty and food insecurity remains elevated.

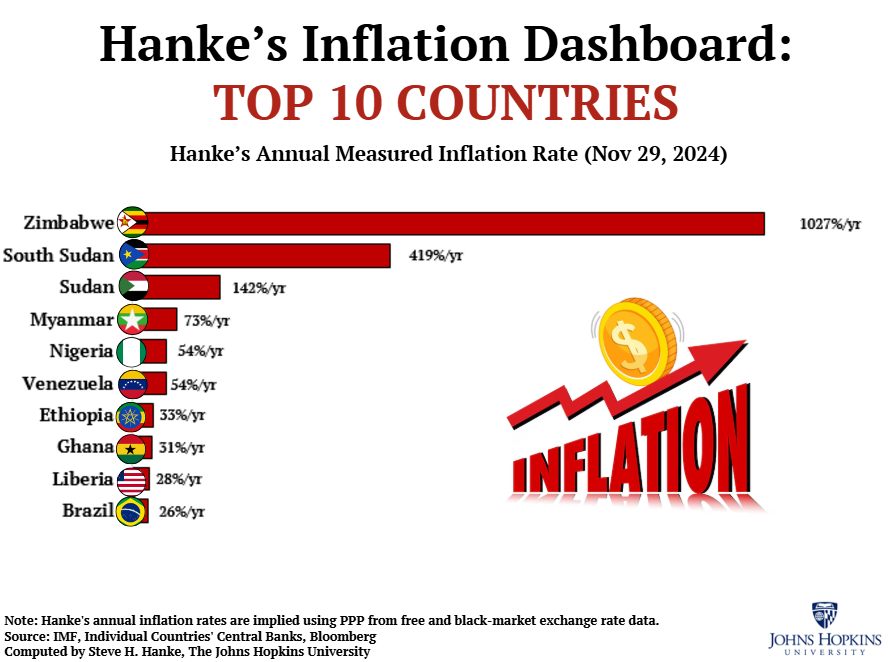

On 8 December 2024, Johns Hopkins University professor Steven Hanke measured Zimbabwe’s annual inflation at 1 027%, the highest in the world. Curiously, the state-run Zimbabwe National Statistics Agency calculated annual US dollar inflation at 3.3% in November 2024.