Staff Writer

IN a report laying bare Zimbabwe’s serious economic challenges, the World Bank says the country’s public debt is in distress and unsustainable, constraining access to international finance and stoking macro-economic instability.

The international financial institution, in a new report titled Zimbabwe Economic Update 2024: Improving Resilience to Weather Shocks and Climate Change, reveals that the country’s public debt in 2024 stood at US$21.1 billion or 101% of gross domestic product (GDP).

“Zimbabwe’s public debt is in distress and unsustainable, constraining access to international finance. As a result of accumulation of external arrears, legacy debt, the absorption of RBZ [Reserve Bank of Zimbabwe] debt, and a large one-off transfer to the Mutapa Investment Fund, total public debt rose to US$21.2 billion in 2023 (97% of GDP). Most of this increase was in domestic, USD-denominated debt. In 2024, public debt stood at US$21.1 billion (or 101% of GDP),” says the World Bank.

The bank explains that the debt-to-GDP ratio has been volatile, largely on account of exchange rate dynamics.

“While Zimbabwe’s total debt has been increasing, the debt-to-GDP ratio has been volatile due to exchange rate dynamics. Changes in the debt-to-GDP ratio are driven in large part by stock-flow adjustments from exchange rate depreciation and the gap between the average and end-of-period exchange rates.

“This leads to a situation where Zimbabwe’s 2023 GDP is at US$35.5 billion (using year-average exchange rates), but aggregate debt is US$21.2 billion and 96.6% of GDP (using year-end exchange rates).

A debt-to-GDP ratio of 100% means that a country’s total government debt is equal to the value of its entire annual economic output — essentially, the country owes as much money as it produces in a year, indicating a potentially high level of financial strain and potential concerns about its ability to repay debts.

Taxpayers inherit odious debts

In a scandalous move that goes against the dictates of prudent public financial management, the government has placed the RBZ’s US$2.86 billion debt on the shoulders of long-suffering taxpayers.

RBZ headquarters in Harare, Zimbabwe.

The total RBZ liabilities assumed by Treasury in 2015, 2021 and 2023 amounted to US$2.86 billion as at the end of September 2024. These liabilities are now being serviced through the National Budget. Social justice activists accuse the government of lacking transparency and accountability in foisting the RBZ debt onto taxpayers. Some of the debt is clearly odious, for instance the US$200 million Farm Mechanisation Programme which supplied agricultural equipment to defaulting farmers whose names are known. Many of the beneficiaries are political elites and their cronies. Why should taxpayers inherit such debts when the culprits are known?

The World Bank says the transfer of the RBZ debt to taxpayers is problematic.

“The transfer of the RBZ’s external debt to the Treasury, together with the payments of Treasury Bills associated with the increased capital spending in 2023, also resulted in steep increases in the Treasury’s debt servicing costs. At the same time, the El Niño-related drought increased fiscal pressures to support vulnerable households with maize and agricultural inputs.”

Paying a hefty price

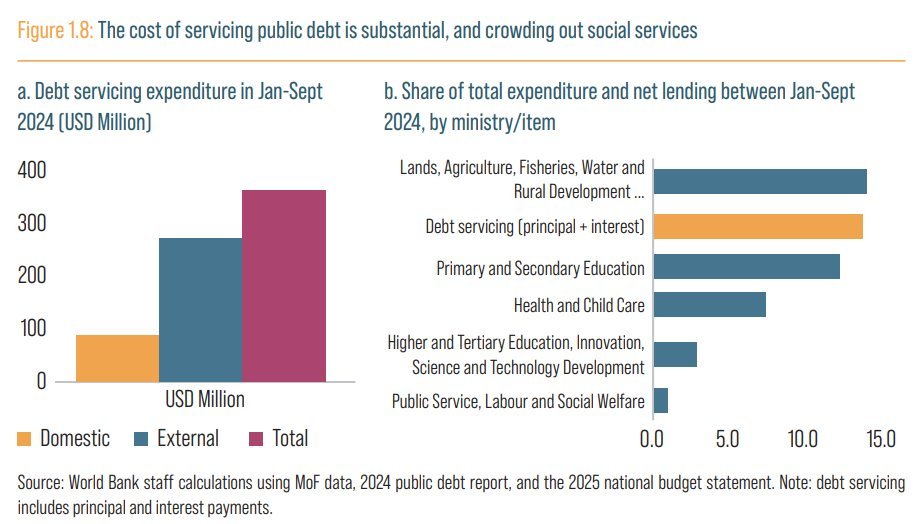

Citizens are paying a heavy price as the government’s debt repayments are crowding out social spending. The government’s capacity to fund health and education are constrained.

Treasury shelled out US$368 million in the period from January 2024 to September 2024 in debt repayments. Comparatively, this means the amount spent on debt servicing, at 13.8%, is more than what the Zimbabwean government spent on health (7.4%) and schools (12.3%). See table below:

The World Bank acknowledges that the country is undertaking a debt resolution dialogue facilitated by former Mozambican president Joaquim Chissano and whose champion is African Development Bank president Akinwumi Adesina. In addition, an International Monetary Fund Staff-Monitored Programme is scheduled to commence in the first quarter of 2025. Both processes are expected to provide solutions to the country’s economic problems.

Zimbabwe will have to contend with significant headwinds before the idea of achieving stability can be conceived.

“The economy is facing multiple downside risks. Given the vulnerability present in the economy, varying risks may evolve from price stability, exchange rate, contingent liabilities, and climate change-induced natural disasters.”