ZIMBABWE’S runaway cost of living is still among the highest in the world, with the biggest drivers being food and non-alcoholic beverages.

Although the official numbers for March show a slight decline, the lived reality among poverty-stricken citizens is that of an extremely unbearable existence. There are serious implications for food security at household level.

A volatile mix of economic mismanagement, corruption-induced poverty and political instability has plunged Zimbabweans into untold misery.

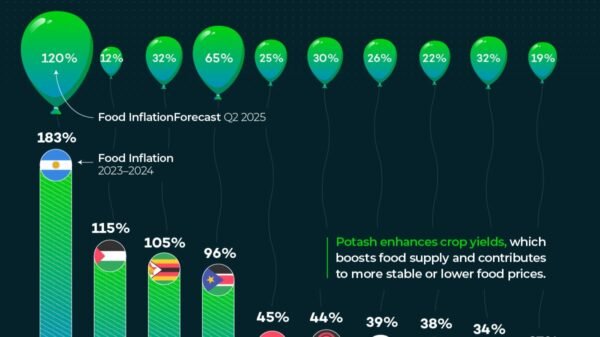

Johns Hopkins University economist and international currency expert Steven Hanke has computed Zimbabwe’s annual inflation rate at 115% as at 28 March 2025 — the third-highest in the world.

League of infamy…Hanke says dollarisation is Zimbabwe’s only hope.

This figure is in stark contrast to the official Zimbabwe National Statistics Agency numbers for March which placed the year-on-year US dollar inflation rate at 15%, and the local currency-denominated rate at -0.1%.

South Sudan tops the chart, at 189%, followed by Venezuela (186%). Taking up the other slots in the top-five are Sudan (94%) and Iran (75%).

Hanke says “Zimbabwe’s only hope” is dollarisation.

Nathan Lewis, a fellow at the Discovery Institute’s Centre for Wealth and Poverty, has identified bad governance as a major malady afflicting economic management in Zimbabwe.

“Unfortunately, despite having an interest in a new currency fixed to gold, Zimbabwe is living down to all the worst examples of African governance,” Lewis remarked.

Lewis is the author of four books on economic topics, including three about the gold standard. He particularly points out that the local currency, the Zimbabwe Gold (ZiG), is fixed to gold, yet the local unit has lost value since launch in April 2024.

Zimbabwe is living down to all the worst examples of African governance

Nathan Lewis

In September 2024, the ZiG was devalued by 43%, taking it from 13.56 ZiG to the US dollar at its launch to 24.4 ZiG to the dollar. By 4 April 2025, the rate was US$1: ZiG 26.78.

Claims by the Zimbabwean authorities that the ZiG is backed by gold have been met with scepticism. On 1 April 2025, gold futures hit a new record price of US$3 177 per ounce. Bizarrely, the ZiG has weakened despite the strengthening of gold.

What makes it more puzzling is that Zimbabwe’s gold export earnings increased by 8.64% in the first two months of 2025.

Living wage elusive

Obert Masaraure, the president of the Amalgamated Rural Teachers’ Union of Zimbabwe, recently told the Citizens’ Voice Network that teachers are wallowing in poverty.

Life is tough…teachers, nurses and other workers in Zimbabwe are struggling to survive on meagre salaries.

The union is demanding a basic monthly salary of US$1 260, which Masaraure says will enable teachers to buy food, pay rent, send children to school, and cover the costs of medical aid and transport.

In view of the high cost of living, teachers have denounced their current salary as “a starvation wage”.

An unhappy nation

Zimbabwe is the third least-unhappy country in Africa, according to the World Unhappiness Report 2025. The most unhappy nation is Sierra Leone, followed by Malawi.

Mauritius is the happiest country in Africa, scoring highly for its stable democracy, strong economy, and relatively higher quality of life. The Indian Ocean island is also the most peaceful country in sub-Saharan Africa, according to the Global Peace Index.

The index is an annual publication that ranks global happiness based on life evaluations, social support, freedom, gross domestic product per capita, and other well-being indicators, using data from the Gallup World Poll and additional sources.

Crisis is real

According to Hanke’s dashboard, Zimbabwe’s 115% annual inflation rate is the third-highest in the world.

An annual inflation rate of 115% per year indicates that the cost of living in Zimbabwe is rising extremely rapidly. For example, if a basket of goods costs US$100 today, it would cost US$215 in one year. This doubling (and more) of prices within a year makes it very difficult for people to afford basic necessities like food, housing and healthcare.

Worthless earnings

With such high inflation, the value of money decreases rapidly. If wages or incomes do not increase at a similar rate (which is often the case in hyperinflationary environments), people’s purchasing power diminishes significantly. For instance, if someone earns US$300 per month, but prices double in a year, their salary effectively buys half as much as it did before, assuming their income stays the same.

High inflation erodes the value of savings. Money saved in a bank or kept in cash loses its value quickly. For example, US$1 000 saved today would only have the purchasing power of about US$465 in a year (since prices would have more than doubled). This discourages saving and can lead to a cycle of spending money as soon as it is earned to avoid losing value.

As the cost of living rises faster than incomes, more people are falling into poverty.

The 115% year-on-year inflation rate in Zimbabwe indicates a severe cost-of-living crisis. Prices are more than doubling annually, making it increasingly difficult for people to afford basic goods and services. This level of inflation is eroding purchasing power, discouraging savings, and exacerbating poverty and economic hardship for the population.

Without significant economic reforms or stabilisation measures, the cost of living in Zimbabwe will continue to spiral, making daily life a struggle for many.–Staff Writer.